Understanding gold price action analysis in African markets

As far as African markets are concerned, this yellow metal is more vital, for it has cultural, economic and financial importance.

The article tries to discuss how one can analyze the gold price action from an African perspective, digging into distinctive factors that drive its prices and ways of handling these emerging markets.

Gold and Its Role in African Economies

Gold is a cornerstone of several African economies, led by South Africa, Ghana and Tanzania. It is a vital contributor to the GDP, being one of the most vital commodities for export. Its mining provides employment and creates infrastructure, while it influences national currencies.

These economies have proved very sensitive to trends in the price of gold a fact that makes understanding those trends exceedingly important both to the governments and to investors.

How to Trade Gold in African Markets

To those wondering how to trade gold, it is important to understand the peculiarities of opportunities and challenges that await traders in African markets.

Traders can physically trade in gold, participate in the futures contract or invest via an exchange-traded fund. Physical trading is quite popular because one can see, feel and touch his or her gold and hence it is culturally relevant to many.

However, digital platforms have democratized access to global markets and allowed African traders to extend their range of strategies. Understanding the nuances of options and infrastructure available in specific countries will be of immense help to traders.

Key Factors Influencing Gold Prices

The price of gold in Africa, at large, is influenced by various factors to do with global trends. Globally, changes in the US dollar, interest rates and geopolitical tensions all contribute to changes in the price of gold.

Locally, in African markets, it may be a function of the mining regulatory environment, the relative strength of the currency and the export policy environment. On the other hand, political unrest in producer countries increases volatility in these prices as a result of the resultant disruption in supply and decline in investor confidence.

Global Trends and Their Impact

As a commodity marketed globally, gold is highly attached to the demand of major economies like China and India. Whenever there is worldwide inflation or the US Dollar becomes weaker, gold definitely is considered an asset wherein the prices surge.

Some African markets usually are export-oriented to this region and follow these dynamics. However, local disparities, including those in production conditions and labour relations, come with a difference in price discrepancies.

Currency Fluctuations and Gold Price Movements

Large ranges of currency volatility in so many African countries also act as big drivers of gold prices: depreciation of the local currencies against the US dollar makes the metal more expensive internally and can create a very decent opportunity for traders and investors.

On the other side, a strong currency usually keeps the gold prices down in the locality and seriously affects profitability due to mining operations. Monitoring such trends in currency markets will be a part of his or her business in predictions arising ahead of market behaviour.

Analyzing Gold Price Action

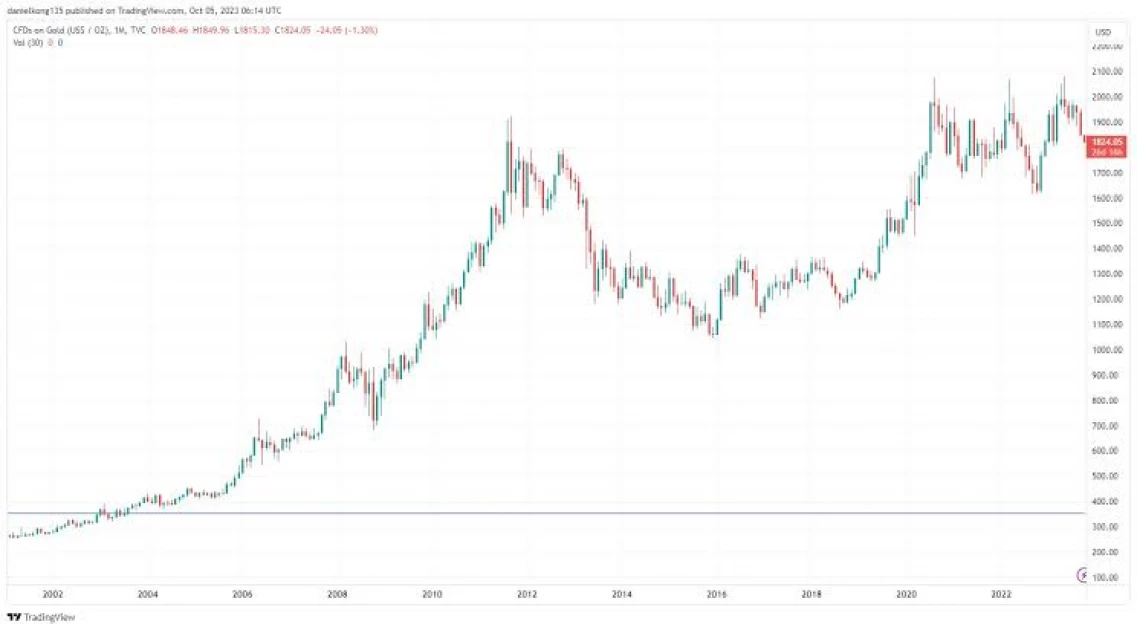

A trader should combine both technical and fundamental analysis to effectively analyze the action of gold prices. While fundamental factors like mining output, global demand and local economic conditions set the context within which prices would move, technical analysis through candlestick charts, moving averages and momentum indicators helps traders understand the trend and possible points of entry or exit.

In African markets, integrating these approaches with local insights such as political developments or mining regulations, can provide better predictions.

Challenges and Opportunities in African Gold Markets

While the African markets do hold much promise for gold traders, at the same time, there are several risks involved, political instability, alteration of existing rules and regulations and inadequacy of infrastructure are quite unpredictable.

Ironically, the same reasons contribute to enhancing the demand for gold, seen as a safer asset under unstable political conditions.

From these perspectives, investors simultaneously observe this dual nature of both opportunities within market gains and signs to keep away. Developing well-founded knowledge regarding the region's dynamics will be essential for effectively tackling such problems.

The Future of Trading Gold in Africa

The outlook is bright and promising for the trading of gold in Africa, rooted in both domestic and global factors. Improved mining efficiency through investments in mining technologies and infrastructure, coupled with enhanced access through a growing universe of digital platforms, is accommodating a wider diversity of investor types.

In this strong tailwind of gold demand seen across the globe, Africa does stand at a good place to play its role significantly in the future of gold as a commodity. Traders who stay informed and adapt will find ample opportunities in such a dynamic market.

Conclusion

Understanding gold price action in any of the African markets largely calls for an approach that balances global trends with local causes.

From economic conditions down to geopolitical events, the balance of various elements shapes this market's dynamics. Combining techniques with local insight can widely open up opportunities for investors in their quest for profit, whether one is trading in either physical gold or even exploring digitized platforms.

Those looking to be successful in this space will have to study how to trade gold effectively and adapt to the particular market conditions found in Africa.

Want to send us a story? SMS to 25170 or WhatsApp 0743570000 or Submit on Citizen Digital or email wananchi@royalmedia.co.ke

Comments

No comments yet.

Leave a Comment