Tougher times for Kenyans as 184 MPs vote to increase VAT on fuel from 8% to 16%

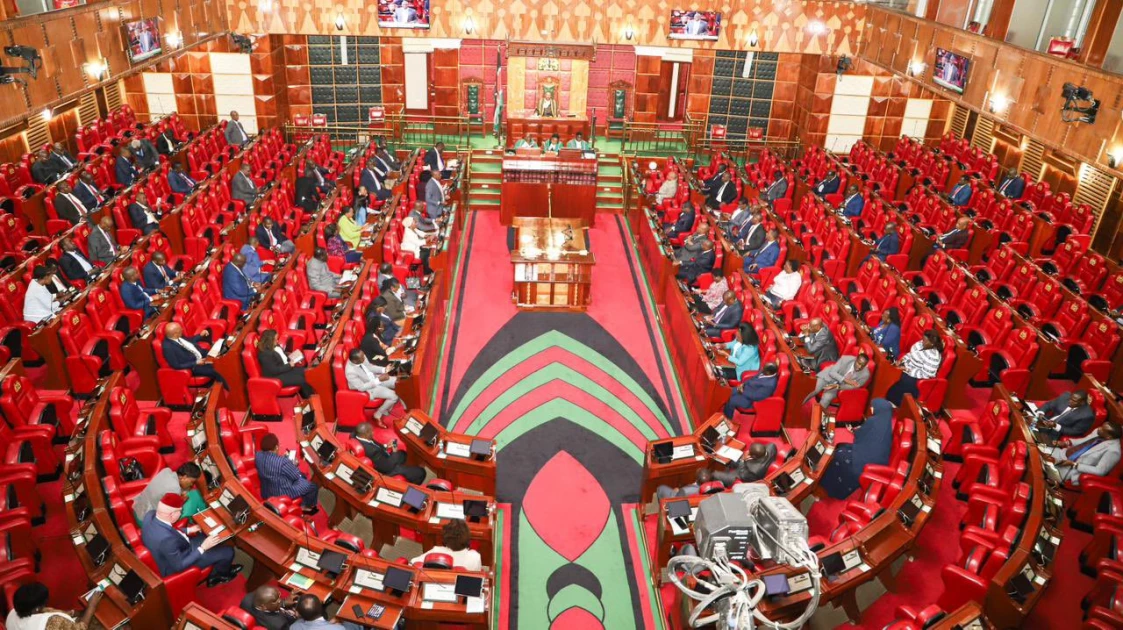

File image of MPs in the National Assembly.

Kenyans are staring at tougher economic times after a majority of Members

of Parliament on Wednesday approved the contentious proposal in the Finance

Bill, 2023 to have Value Added Tax (VAT) on fuel increased from the current

eight per cent to 16 per cent.

After a heated debate that saw Azimio and Kenya Kwanza MPs lock horns in the House, 184 MPs

voted in favour of the increase in VAT to 16 per cent against 84 who opposed

the amendment, setting the stage for what could see the cost of fuel rise by

more than Ksh.10.

Azimio opposition coalition MPs who largely opposed the proposal to increase the VAT on fuel to

16 per cent argued that the move would adversely affect the cost of living.

Kitui Central Member of Parliament Makali Mulu who had moved an amendment to have the Clause on

increasing VAT on fuel deleted from the Finance Bill 2023, argued that anytime

VAT of fuel is increased, it results in higher costs of transportation,

manufacturing, production as well as electricity.

Minority Whip Junet Mohamed termed the Clause on increasing

of VAT as the “most offensive” to Kenyans, warning that it could be a precursor

of a revolution in the country.

“This is the most offensive clause in this bill. When you

increase VAT from 8 to 16% that is one thing that is going to make life very

expensive for Kenyans,” said Junet.

He went on to accuse the Kenya Kwanza government of

hoodwinking Kenyans by promising to remedy the cost of fuel by reducing taxes.

“Kenya Kwanza told us the problem with fuel is taxation. They

promised to look into taxation. Now this afternoon in broad daylight, they are

telling us to increase taxes on fuel. What a paradox it is. Let us agree on

this one, we must remove VAT on fuel otherwise there will be a revolution in this

country if this one passes,” said Mohamed.

Minority Leader Opiyo Wandayi also strongly opposed the

recommendation, stating that any attempt to increase the cost of fuel would

mark the saddest day in Kenya’s history.

“If this clause

becomes part of the Bill and VAT on fuel is increased to 16 % this will be the

saddest day in the history of this country. If there is one thing that is going

to affect the common person, increase the cost of living in all aspects it is

this proposed increment on VAT on fuel,” said Wandayi.

“If there is one thing this government should have done to

the so-called hustler was to cushion the hustler from an increment in the cost

of fuel.”

Wandayi discounted an argument by the Chairperson of the National Assembly Finance and Planning Committee Kuria Kimani

that VAT on fuel should be increased to bring it to a par with other vatable

products and services.

“There is nowhere in the law where we are compelled to have

a uniform rate of VAT on all products and services. VAT rates can vary and they

have varied before,” added Wandayi.

Githunguri MP Gathoni Wamuchomba once again reiterated her

position that despite being elected under the ruling UDA Party, she would not

support any legislation that would burden Kenyans.

“Life is unbearable as we speak to our citizens. We cannot

afford to add more levy on fuel because fuel is a catalyst of everything from

production to marketing and to the welfare of our people. Right now our people

are suffering and production, especially in our rural areas is going to go to

zero if we add tax on fuel,” said Wamuchomba.

“ If you want to revamp the economy of this country adding tax on fuel is not the solution. The solution is empowering our farmers who produce crops that bring donors to this country,” she said before pronouncing her vote as No.

Budget and Appropriations Committee Chairperson Ndindi Nyoro brushed off attempts by the minority side to oppose the proposal to increase VAT on fuel, instead challenging them to offer other alternatives to raise revenue.

“In the 2023/24 budget, we have allocated Ksh.25 billion that is going to fuel subsidy that was promised but was never paid. Also Ksh.250 billion has been allocated to roads.

“Those who may not agree with the amendment from the chair they should give us other revenue measures. You cannot have your cake and eat it,” said Nyoro.

"It is indeed true that a rise in VAT by 8 per cent will occasion a rise on fuel prices.... But our VAT rate at 16 per cent, in the region where our country is the market leader, VAT in Kenya even at 16 per cent is still the lowest. Uganda being at 18 per cent on fuel, our friends in Tanzania and Rwanda also at 18 per cent," he said.

The National Assembly is currently considering several

proposed amendments to the Finance Bill, 2023 that is currently at the Committee

of the whole House stage before it is enacted into law.

Want to send us a story? SMS to 25170 or WhatsApp 0743570000 or Submit on Citizen Digital or email wananchi@royalmedia.co.ke

Comments

No comments yet.

Leave a Comment