China maintains 2025 GDP growth target at 5%, strengthens fiscal policies

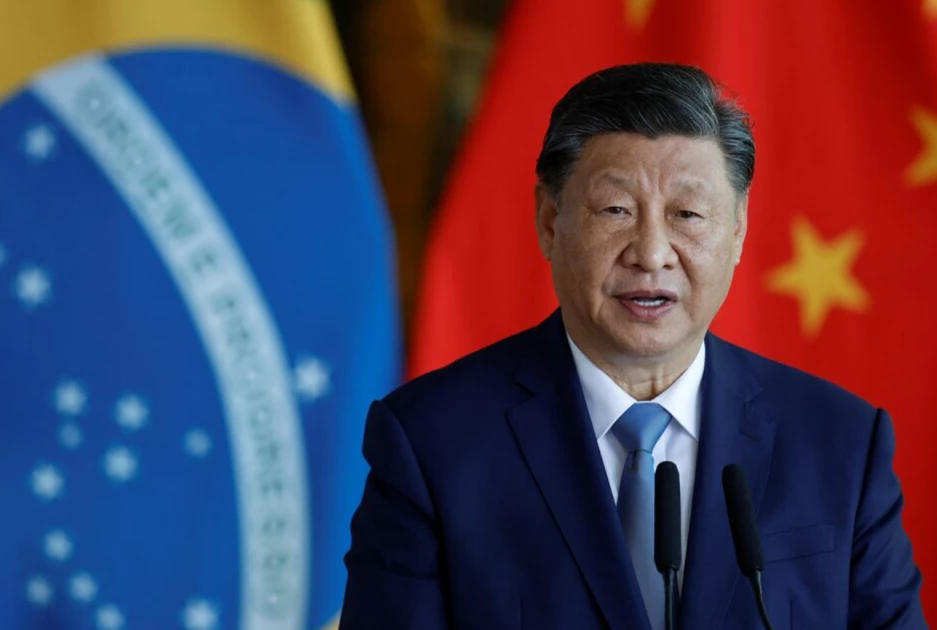

China's President Xi Jinping makes a statement following the signing of bilateral agreements with Brazil's President Luiz Inacio Lula da Silva, in Brasilia, Brazil November 20, 2024. REUTERS/Adriano Machado/File Photo

China has decided to keep its GDP growth target at around 5 percent for 2025, marking the third consecutive year of maintaining this goal.

According to the latest Government Work Report, the nation is

focusing on stimulating domestic demand amid an increasingly complex global

economic environment.

Economists and industry leaders say this steady growth target

reflects the government's strategic commitment to long-term economic stability,

prioritizing consumption and improving living standards.

Premier Li Qiang, who presented the report at the third

session of the 14th National People's Congress in Beijing, emphasized that the

growth target aligns with China’s mid- and long-term development objectives,

demonstrating the country's determination to overcome challenges.

China has pursued a "proactive" fiscal policy for 16

consecutive years, but this year's report signals an even "more proactive

fiscal policy."

The government has raised the projected fiscal deficit-to-GDP

ratio to approximately 4 percent, up from last year's 3 percent—its highest

level since 2010, according to data from Wind Info.

Liu Jing, chief China economist at HSBC Global Research, noted

that this policy shift aims to anchor market expectations and strengthen

efforts to boost domestic demand, with fiscal measures playing a leading role.

To support this initiative, China will issue 1.3 trillion yuan

($179 billion) in ultra-long-term special treasury bonds this year, up from 1

trillion yuan in 2024.

Additionally, the government will issue special local

government bonds worth 4.4 trillion yuan, compared to 3.9 trillion yuan last

year.

Another 500 billion yuan in special treasury bonds will be

allocated to help large state-owned commercial banks replenish capital.

China’s new government debt for 2025 is set at 11.86 trillion

yuan, representing a 2.9 trillion yuan increase from last year, reflecting a

substantial expansion in fiscal spending.

"The strength of fiscal policy has increased

considerably, reflecting a significant change in fiscal philosophy," said

Luo Zhiheng, chief economist at Yuekai Securities.

Wang Qing, chief macroeconomic analyst at Golden Credit Rating

International, estimated that the higher deficit-to-GDP ratio alone could

contribute around 1.2 percentage points to GDP growth, helping to offset

external demand slowdowns.

For the first time in over a decade, China’s work report has

signaled a shift toward a "moderately loose monetary policy,"

departing from the "prudent" stance maintained since 2011.

The report indicates plans for timely reductions in the

reserve requirement ratio and interest rates, as well as new structural

monetary policy tools to support the real estate sector and stock market.

Chen Changsheng, deputy director of the Research Office of the

State Council and a member of the report’s drafting team, highlighted the

government’s renewed focus on boosting consumption and improving living

standards.

Notably, stabilizing the real estate and stock markets has

been listed as a major annual task for the first time.

The report outlines several initiatives, including: Childcare

subsidies; Increasing the minimum basic old-age benefits for rural and

nonworking urban residents by 20 yuan per month; Allocating 300 billion yuan in

ultra-long-term special treasury bonds to consumer goods trade-in programs.

Janice Hu, China country head at UBS AG and chairperson of UBS

Securities, remarked that these measures could gradually strengthen household

confidence and stimulate long-term consumption growth.

For the first time in two decades, China has set its consumer

price index (CPI) growth target at around 2 percent, signaling a shift from

merely controlling inflation to actively targeting a specific price level

through demand recovery.

Additionally, the government plans to introduce city-specific

policies to adjust or ease property transaction restrictions, strengthen

strategic resource reserves, and enhance market stabilization mechanisms in the

capital market.

China also aims to further open up internet-related and

cultural sectors while ensuring the legal protection of private enterprises and

entrepreneurs.

The government will promote large-scale applications of new

technologies and products as part of its broader economic strategy.

With these robust fiscal and monetary measures, China is

positioning itself to maintain steady growth while addressing internal and

external economic challenges in 2025.

Want to send us a story? SMS to 25170 or WhatsApp 0743570000 or Submit on Citizen Digital or email wananchi@royalmedia.co.ke

Comments

No comments yet.

Leave a Comment