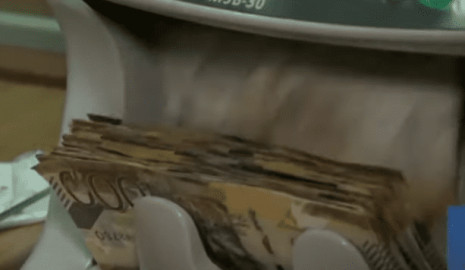

Treasury takes Ksh.27.6 billion from second April bond sale

The National Treasury has taken a further

Ksh.27.6 billion in proceeds from the second bond sale in April.

This against higher investor bids which

totalled Ksh.32.5 billion against a target of Ksh.30 billion for the bond

auction which closed on Tuesday to represent a 108.5 per cent performance rate

on the issue.

Cumulatively, the National Treasury has now

raised a combined Ksh.60.7 billion from its sale of two bonds with tenures of

three and 15 years respectively this month.

Both the investor and accepted bids for the

two offers have nevertheless been below the exchequer target of raising Ksh.70

billion from the domestic credit market through bonds in April.

At the same time, the National Treasury and

the Central Bank of Kenya (CBK) have had to contend with aggressive investor

bids which are now pushing the Treasury yield curve upwards.

For instance, the weighted average rate of

accepted bids for the 15-year paper has come in at 13.942 per cent which is

comparable to the reopened 25-year paper issued in May last year.

The rising Treasury yield curve will see the

government pay more for contracted domestic debt in future bills and bond

issues.

The first bond sale this month which raised

Ksh.33.1 billion in proceeds also had an attached premium of 11.766 per cent.

The entire sum of Ksh.60.7 billion is to be channeled

to new borrowing under the closing 2021-2022 fiscal year.

Want to send us a story? SMS to 25170 or WhatsApp 0743570000 or Submit on Citizen Digital or email wananchi@royalmedia.co.ke

Comments

No comments yet.

Leave a Comment